It is a sort of Insurance that offers medical coverage against medical costs coming out of a health emergency. A health insurance plan provides financial help to the policyholder to cover hospitalisation costs, daycare procedures, ICU charges and critical illness benefits.

It is indemnity based Insurance that offers comprehensive coverage with many benefits, including advanced medical treatments, daycare treatment, cashless hospitalisation, AYUSH, and that's only the tip of the iceberg. If hospitalisation is needed during the policy time frame, you don't have to pay from your side. The health insurer will bear your medical costs subject to policy T&C.

There is a premium that you need to pay for the coverage you get under the policy. You can track down the different choices for the sum insured to select according to your medical care needs.

The Necessity of Health Insurance

Your family's health and prosperity matter the most for you.

However, the pandemic has been an update that we live amid

vulnerabilities. Along these lines, having a standalone health

insurance cover is beneficial. Without health insurance, the

financial effect of causing unforeseen hospital expenses can be

overwhelming, given the heightening health care expenses.

Health Insurance is a reasonable investment that guarantees a

safe future. The pandemic has changed everybody's perspective as

an ever-increasing number of individuals are starting to

understand that health Insurance is something more than a

tax-saving tool. It is the need of great importance since

getting medical aid is becoming costly.

Medical inflation is increasing each day, leading to expensive treatments. If you get hospitalised for a critical illness or lifestyle disease, you might wind up losing all your savings. The best way to bear the cost of quality medical treatment during a health crisis is by buying a Health Insurance Policy. Here are several reasons why you need to buy a health insurance plan:

Get Quality Medical Treatment -

It assists you with managing the cost of the best quality medical treatment and care so you can concentrate on getting cured.Protect Against Lifestyle Diseases -

Pay for the long-term treatment of lifestyle diseases like heart attack, cancer, and so forth that have been on the rise with the evolving ways of life.Secure Your Savings -

It assists you with securing your well-deserved savings by covering your medical costs so you can benefit from the necessary treatment with next to no financial concerns.Cashless Hospitalization Facility -

It permits you to get a cashless hospitalisation facility at any of the network hospitals of your Insurance provider by raising a cashless claim.Survive Medical Inflation -

A health Insurance policy can assist you with taking care of your medical expenses, including pre and post-hospitalisation costs, notwithstanding the rising medical expensesTax Benefits -

It facilitates you to save tax on the Health Insurance expense you've paid under section 80D of the Income Tax Act for better financial planning.Attain Peacefulness -

It permits you to get medical treatment with peace as you don't need to stress over covering the high-cost hospital bills.*Note: Tax allowance on health Insurance premium is subject to rules and guidelines of the Income Tax Act.

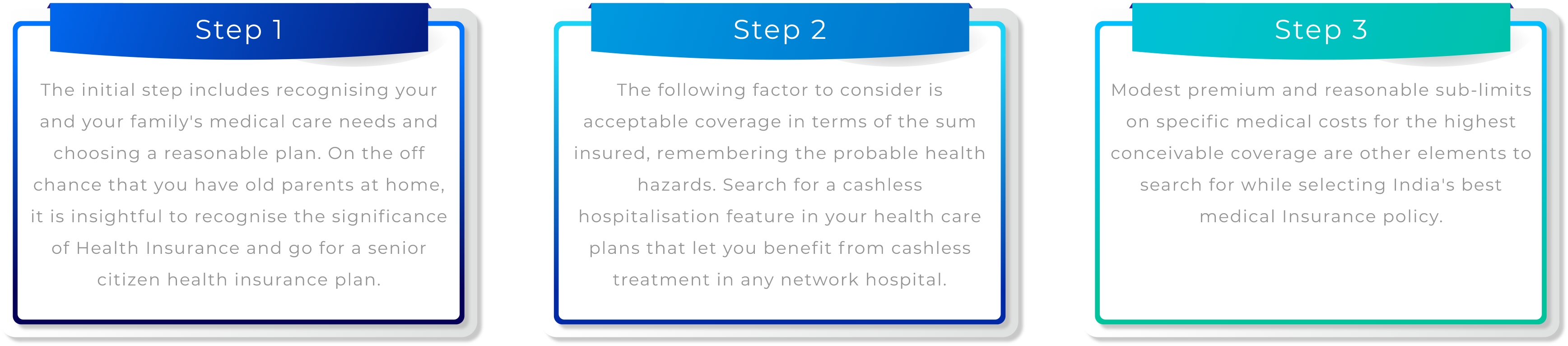

Selecting the best health insurance plan includes cautious planning and considering various factors:

Top 7 Crucial Things to Examine Before Buying a Health Insurance Policy

Here are a few essential points which will assist you with settling on an informed choice while looking for the best health insurance in India:

What Health Insurance Plan Covers?

Most Health Insurance companies in India cover the accompanying medical costs under a health insurance policy:

In-Patient Hospitalisation

Cover your costs like room rent, ICU charges, doctor's fees, and so on, during any planned or emergency hospitalisation up to the sum insured.

Pre-Hospitalization Medical Expenses

Cover your medical costs like doctor's consultation, medical tests, and medications as long as 30 days before admission to an emergency hospital.

Post-Hospitalization Medical Expenses

The medical costs, as follow-up visits and medical trials, are covered to 60 days following discharge from the hospital.

Advanced Medical Treatments

Access advanced medical care and seek coverage for such treatments, including robotic surgery procedures, within a Health Insurance Policy.

Daily Allowance

The regular costs during hospitalisation can be significant! We give a proper sum to cover them.

Domiciliary Hospitalization

Some health plans offer this advantage where the domiciliary care medical costs are covered up to a predetermined period.

Covid-19 Treatment

Protect yourself from the COVID-19 pandemic as health insurance covers specific costs of Covid treatment.

AYUSH Treatments

Try not to let the absence of proper finances dissuade your confidence in alternative medication. Now, we cover AYUSH treatments as well!

What is Not Covered in Health Insurance?

Before you continue to select the right health cover for your requirements, look at the exclusions referenced in the policy documents. Doing as such will keep you ready for any possibility. Exclusions are costs or the different situations when you may not be qualified to get a claim under your health policy. The exclusions include:

*Note: It is advised to look at your policy wordings to get a complete list of exclusions.

Comparing health insurance quotes online helps you select the best health plan to suit your medical care needs. At times, choosing the best health insurance plan, countless insurers offer distinctive health Insurance products with significant provisions. MyPolicyJunction understands the customers' confusion and consequently offers a platform where you can think about various health insurance plans' elements, sum insured and statements online. Here are a few of the significant benefits of comparing, buying and managing a health insurance plan online:

Easy Health Plan Comparison: Comparing diverse health insurance plans online is both efficient and helpful. You don't need to continue to meet with the agents to analyse and choose the best plans. Moreover, a few tasks, for example, paying expenses, renewing the health insurance plans, and so on, are likewise simpler through online mode.

Discover a Policy with Suitable Premiums: If a customer purchases a health plan online, they will want to analyse the premium and select the one that fits their budget. Likewise, no business or agent fees are demanded and thus, the buyer ends up saving a lot of cash.

Admittance to Accurate Information: It offers easy admittance to each medical insurance policy accessible in the market. It likewise saves the purchasers from managing the Insurance agents who are known to give inconsistent and one-sided information more often than not.